The 2023 European Commission’s report on ” The VAT gap in the EU ” confirms the effectiveness of the measures implemented to combat VAT fraud by 2021. New figures, new resources, we list it all for you.

Numerical trends in VAT fraud

The VAT gap is the difference between the amount of VAT normally due and the VAT actually collected .

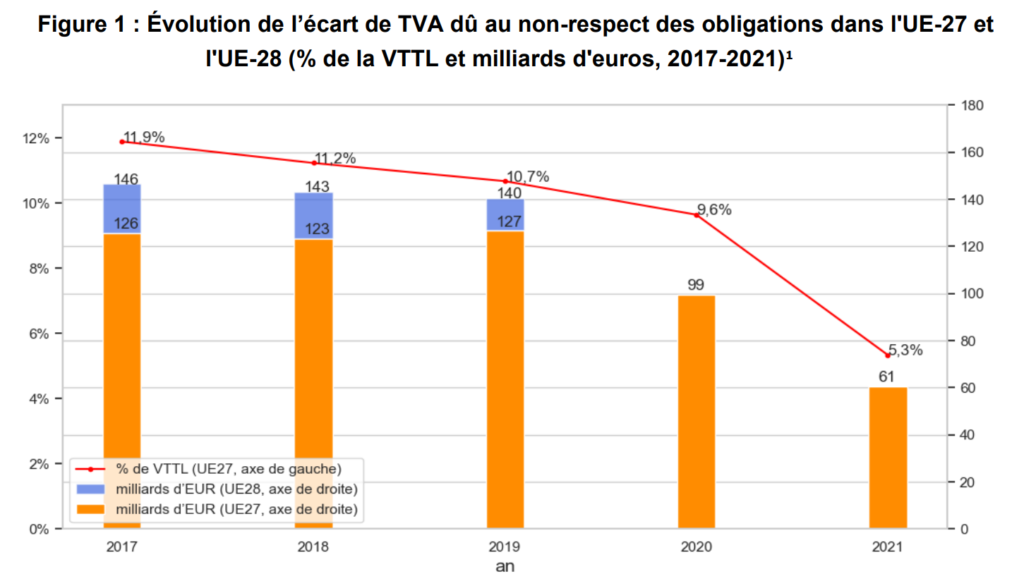

From 2017 to 2021, the VAT gap has narrowed from €146 billion to €61 billion. This VAT gap represents only 5.3% of total VAT revenues in 2021.

The most remarkable reduction is the one from 2020 to 2021, with a drop of 38 billion euros. This development demonstrates the effectiveness of the systems put in place to combat VAT fraud within the EU.

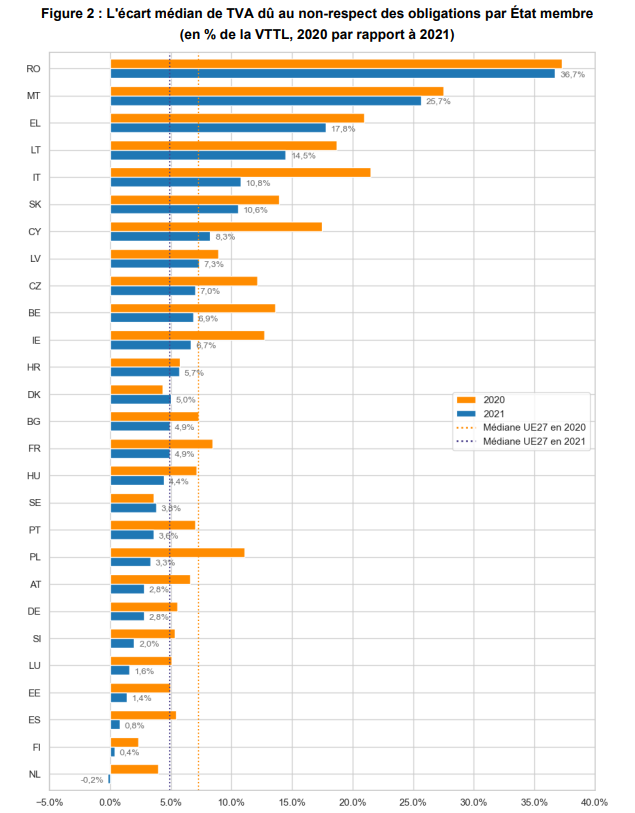

This second graph, produced by the European Commission, shows that the rate of decline varies from one EU member state to another.

With the exception of Sweden and Denmark, the VAT gap decreased in all EU member states. Such changes in more than 8 countries simultaneously had never been seen before.

Who’s doing well when it comes to VAT?

The Netherlands, Finland and Spain are the best performers in this report. In 2021, their VAT gap was less than 1% of their total VAT receipts, indicating that the gap between expected and collected VAT was almost zero.

Who are the poor performers in the VAT gap?

Romania and Malta are the worst performers when it comes to the VAT gap. The report takes the case of Romania, where tax audits have been considered ineffective for many years. The SAF-T system (electronic exchange of accounting data between organizations and the national tax authorities) was not introduced in this country until 2022. Its effects will only be visible in the years to come.

Which countries are making significant progress?

Hungary and Poland have made significant progress. The measures introduced have proved effective in obtaining detailed information on taxpayers’ reporting obligations within these countries, enabling them to reduce VAT discrepancies.

What about France’s VAT gap ?

In terms of figures, France has the second largest VAT gap: VAT tax evasion was reported at 9.5 billion euros in 2021. However, the VAT gap represented only 4.9% of total VAT receipts, putting France at the thirteenth place, within the European average.

A number of factors explain why VAT discrepancies persist: tax fraud, VAT evasion, bankruptcies, miscalculations, financial insolvency… The solutions put in place to improve these factors have led to a significant reduction in the VAT gap in the European Union.

How can we explain the evolution of the VAT gap?

Since the COVID-19 pandemic, other measures have had an impact on the evolution of the VAT gap, with remarkable consequences for results between 2020 and 2021.

Stepping up the fight against tax fraud

Tax evasion is the main reason why countries lose VAT revenue.

In recent years, the EU and its member states have introduced a number of solutions to avoid tax fraud. Two methods are gradually being introduced in the EU:

- Digitizing tax returns ;

- Electronic invoicing.

Poland, for example, has introduced reporting obligations and a national version of SAF-T to combat intra-Community VAT and carousel fraud. This gives the tax authorities access to detailed information, enabling them to detect fraudulent transactions.

The EU’s introduction of the one-stop shop in July 2021 has also helped to reduce tax fraud by simplifying and digitizing VAT declarations in the e-commerce sector. This system has reduced the non-compliant VAT gap with reporting obligations.

Implementation of support measures

The economic recession that followed the COVID-19 crisis helped to limit VAT gaps, from 2020 until the end of the pandemic, support measures have been taken by EU countries to limit the risk of bankruptcy and insolvency.

Reduced business liquidity leads to non-compliance with VAT reporting and settlement obligations, and to an increase in VAT fraud. Thanks to these support measures, companies were able to pay VAT to the Treasury and were encouraged not to commit fraud.

In particular, countries have reduced VAT rates on the supply of certain goods and services to stimulate the economy. Some countries have accelerated VAT refund times and procedures, or extended VAT settlement deadlines. This has limited the number of bankruptcies.

Germany, for example, lowered rates in the catering sector to boost the economy and limit bankruptcies. Tax relief measures, with a change in the VAT burden, have improved companies’ solvency.

What are the challenges of VAT fraud?

Results and variations in VAT differentials reflect the effectiveness of legislation in the various EU member states.

The study of this indicator is essential in the field of VAT collection, in order to develop measures for declaring and paying VAT, and to monitor their effectiveness.

During the Covid-19 pandemic, behaviors changed: online consumption grew and contributed to the rise of e-commerce and marketplaces in Europe. As a matter of fact, when a business sector grows, so does the risk of tax fraud. The European Union and its member states have had to adapt, regulating this type of trade to prevent tax evasion and limit the loss of VAT revenue.

Finally, the harmonization of information transmitted by Member States to the EU through the digitization of declarations and electronic invoicing will ultimately make it possible to limit VAT discrepancies and guarantee the reliability of the data used.

Our experts can keep you updated about the latest European legislation on E-invoicing and E-reporting.