To fill in your Intrastat declarations, you need to identify the customs code of each of your products in the European HS code. Find out more.

Customs codes: what are they?

Customs codes form the basis for compiling external and Intra-Community trade statistics. The HS codes can be denominated in several ways: Intrastat code, customs code, HS code, tariff heading, tariff species, etc.

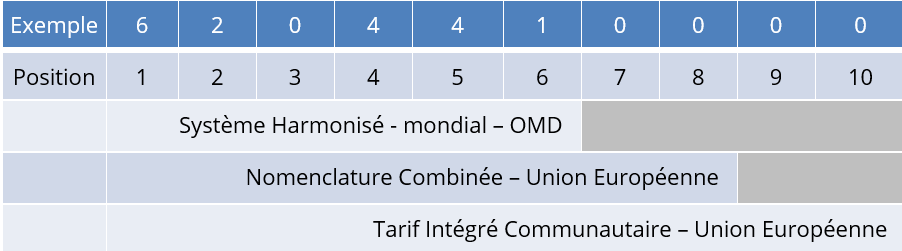

Each product corresponds to a code. These codes are harmonised worldwide and the classification list includes nearly 15,500 references organised into 99 chapters. These codes have between 6 and 10 digits, and are used so goods can be classified internationally:

- HS – Harmonised System, 6 digits – world scale (World Customs Organization) – and HS in English.

- CN8 – 8-digit Combined Codes – European Union

- ICT – Integrated Community Tariff, 10 digits – level for each member state of the European Union.

These codifications are intertwined:

What is the Intrastat code?

To establish Intrastat declarations, the CN code (8) is used. It corresponds to the first 8 digits of the customs code using the Integrated Community Tariff.

How to find your customs code?

To determine the customs code for your goods, you can use the official text available on EUR-Lex, or refer to RITA (Référentiel Intégré du Tarif Automatisé), the reference catalogue updated by the French Customs authorities. This paperless version of the Customs Tariff offers superior search ergonomics.

> Use RITA to determine your customs codes via douane.gouv.fr, RITA Encyclopedia.

Updates to your customs codes

The HS codes, used for the Intrastat declaration, is updated annually.

You can find the 2021 CN on Eur-Lex.

> Discover several ways to update your customs codes with our sister company MATHEZ FREIGHT.

What is the purpose of the customs code?

The 8-digit combined code is used to determine:

- Customs duties

- Taxes and taxation (VAT rates,..)

- Measures of control

- Documents to be produced.

It also makes it possible to identify any tradeincentives or retaliatory measures – tariff suspensions,tariff quotas, anti-dumping duties – and the EC regulations in force:surveillance,restrictions,bans, etc.

Who has to make Intrastat declarations, EC sales lists, EC purchase lists? What are the thresholds, what types of transactions, in what countries? The answers in our VAT guide on Intrastat and EC Sales List / EC purchase List declarations.

No desire or no time to become a VAT expert? Trust us with your obligations. Our fiscal representation service will care of all your VAT obligations simply and securely.