What is tax representation?

VAT tax representation is a service offered by specialized companies accredited by the tax administration. The representative acts as an intermediary between the developing company and the tax authorities of a given country. The advantage of tax representation is that it enables a company to have a VAT number in a territory other than its country of residence , enabling it to operate as a local company without the associated disadvantages, while ensuring the compliance of transactions carried out in that country. The tax representative has various responsibilities:- It analyzes the physical flow of goods and invoices to determine tax and customs obligations;

- He assists his customers in checking the accuracy of invoices, to avoid penalties in the event of errors or omissions;

- He receives the purchase and sales datafrom his customers, verifies them and submits the required tax and customs declarations to the authorities of the country.

What can you do with tax representation?

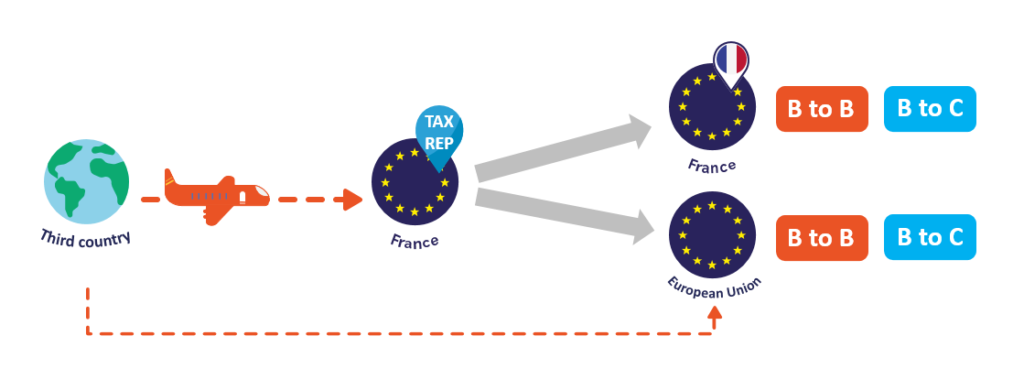

Tax representation can be adapted to different types of company (from small SMEs to multinationals) and different business sectors (from construction to retail, from pharmaceuticals to e-commerce and event organization). As this is such a vast field, we’ve decided to illustrate our point with a few examples:DDP sales in France and/or the EU by an American company :

An American industrial company wants to expand its presence in the European Union to boost its revenue. The company faces direct competition in Germany, and knows that it will need to offer a comprehensive service to its future clients in order to compete with the local competitor. Thanks to its fiscal representation in France, it decides to ensure the entire logistics chain from the United States to delivery at the customer’s premises. The American company offers DDP (Delivered Duty Paid) delivery in all countries of the European Union.

Fiscal representation makes it possible to centralize customs formalities in a single country, rather than delivering directly to each end-customer’s country. Once customs clearance has been completed – in France, in the example given – delivery can be made to end customers located in France or in other countries of the European Union. The choice of country for customs clearance can be important for a company’s cash flow. For example, France is a strategic choice, as the American company will no longer even have to advance the amount of import VAT at the time of customs clearance, thanks to the generalized reverse charge of import VAT dating from 2022.

This example shows that customers could be both professionals and private individuals. French tax representation enables sales in France, the EU, B2B and B2C , without generating additional obligations in the European Union.

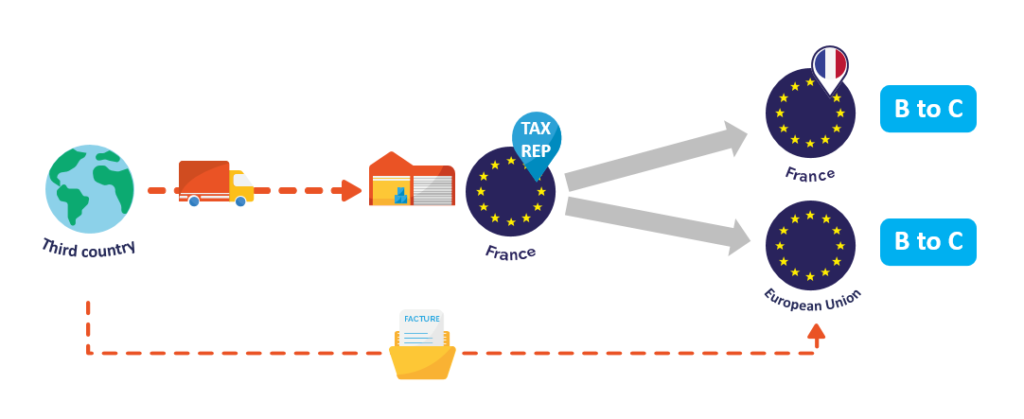

E-commerce sales by a Swiss company with inventory in France:

A Swiss company that sells sporting goods wants to develop its sales on the French-speaking market and then in Europe. To ensure faster delivery, the goods will be shipped to final customers from an external warehouse located in France.

The French tax office supplies the stock of the Swiss entity in France. Goods will be grouped and shipped from Switzerland to France. It is important to note that goods could also arrive directly from suppliers without passing through Switzerland, to optimize logistics. Once in France, and thanks to the simplification of distance selling implemented since July 2021, the Swiss company will be able to sell throughout the European Union with its single fiscal representation. This opens the door to the entire European market.

If the merchandise ordered by an end-consumer is not in stock in France, the Swiss entity will be able to ensure urgent delivery from Switzerland, or even directly from its supplier. Fiscal representation gives us great flexibility in managing operations, so that we can deliver to our customers as quickly as possible.

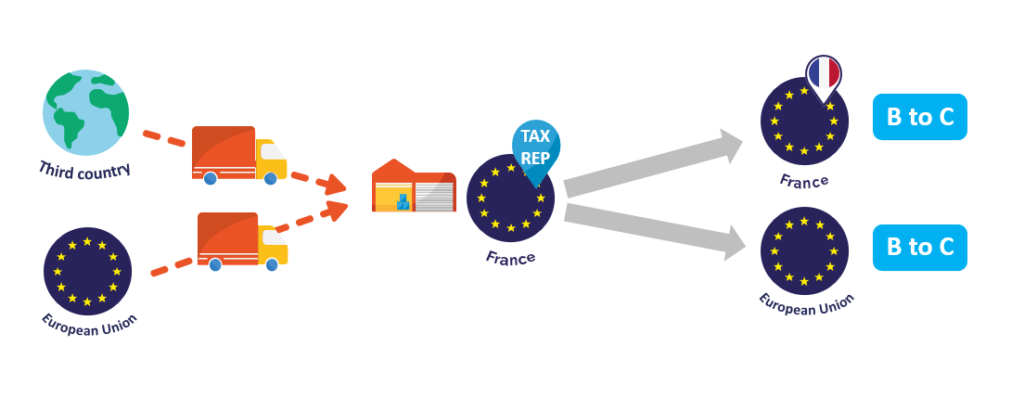

Sales in the European Union since Brexit :

Since the Brexit, British companies have faced numerous challenges, particularly from a logistical, tax and customs point of view. To limit the impact, many of them have decided to set up storage in France, Belgium or the Netherlands to maintain a European presence. For trading companies, this means they can carry out the purchase-resale operation without leaving European territory. For manufacturers, it enables them to store goods in the European Union upstream, so that they can deliver to end customers more quickly and at lower cost.

The fiscal representation for British sellers enables these companies to retain the advantages of the European Union, notably by not having to export and then re-import products in the trading sector, or to carry out customs formalities for each delivery. The latter entail significant costs and the payment of customs duties, which increase the cost of goods. As for warehousing, it also makes it possible to globalize consignments to keep costs down. In other words, fiscal representation makes it possible to minimize the impact of Brexit, enabling companies to continue to develop almost as before while ensuring the compliance of transactions in this new environment.

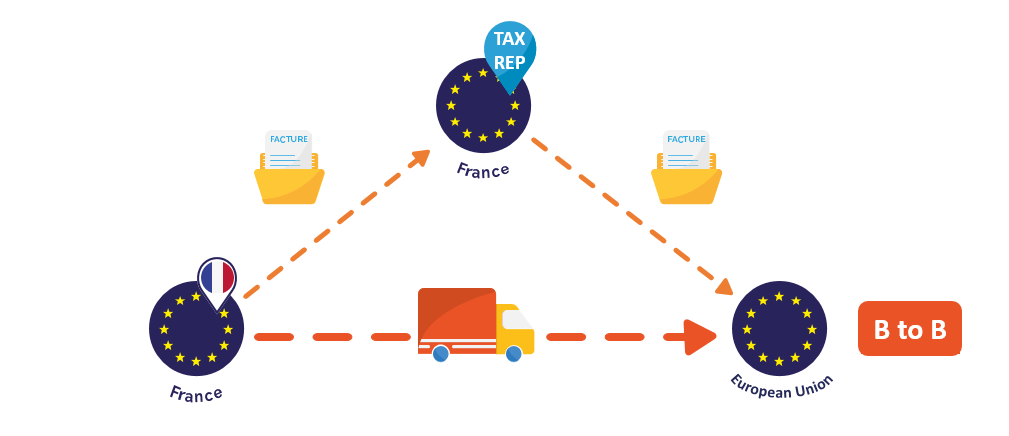

Triangular, with a high degree of opacity between supplier and end customer:

The last example we could mention is the case of triangular transactions. This type of transaction is characterized by three distinct operators (a supplier, a buyer-reseller and an end-customer) and direct delivery between the supplier and the end-customer. This can create challenges for ensuring opacity between supplier and end-customer.

A Norwegian company buys fish from French companies and resells the goods as is to European customers. The Norwegian entity does not process the product, so it is vital to protect the identity of its suppliers to avoid the unfortunate sharing of sensitive data. To protect itself, the Norwegian entity has set up a fiscal representation in France.

Fiscal representation adds a barrier between suppliers and end customers. However, special attention must be paid to transport, to avoid any crossover between the parties. Fiscal representation can also be used to limit the impact of VAT on a company’s cash flow. In such a case, the Norwegian company can request authorization from theFrench tax authorities to purchase its goods tax-free. This avoids having to pay VAT and then wait for a refund, which can be a relatively lengthy process. This scheme would be duplicable with customers based in France, but also outside the European Union.

In conclusion, tax representation is a solution that enables a company to develop with complete peace of mind. It can be adapted to a wide range of situations. If you would like to confirm the feasibility of tax representation for your expansion, contact Easytax an expert will be happy to answer your questions.

That’s why EASYTAX is here to support you with your VAT obligations and issues across all EU countries, providing you with a single point of contact to manage all your EU requirements. This ensures a simple, reliable, and efficient representation, with direct communication throughout the entire process.