How are charters from one or more EU Member State taxed? What are the VAT rules for charters? When should you appoint a fiscal representative or tax advisor?

A summary by the experts

Charters lasting less than 90 days departing from an EU Member State are subject to VAT at the place where the yacht is made available, on the date the contract starts, whether or not the passengers are on board.

Some Member States have opted, as authorised by the European VAT Directive, not to tax charter fees for the part of the hire which corresponds to the segment of the navigation carried out outside of EU waters. This is the case in France and Italy. The methods of calculating the tax basis, and therefore the non-taxable part of the fees, differ from country to country. In order to benefit from these provisions, yachts must provide evidence. What is required varies according to national regulations (logbooks, AIS tracking, etc.)

Charters lasting less than 90 days departing from a third country and passing through the territorial waters of certain EU Member States are subject to VAT on the part of the journey located within the EU waters of countries exercising this option.

The methods of calculation and proof also vary from one State to another.

Examples of charters in the Mediterranean

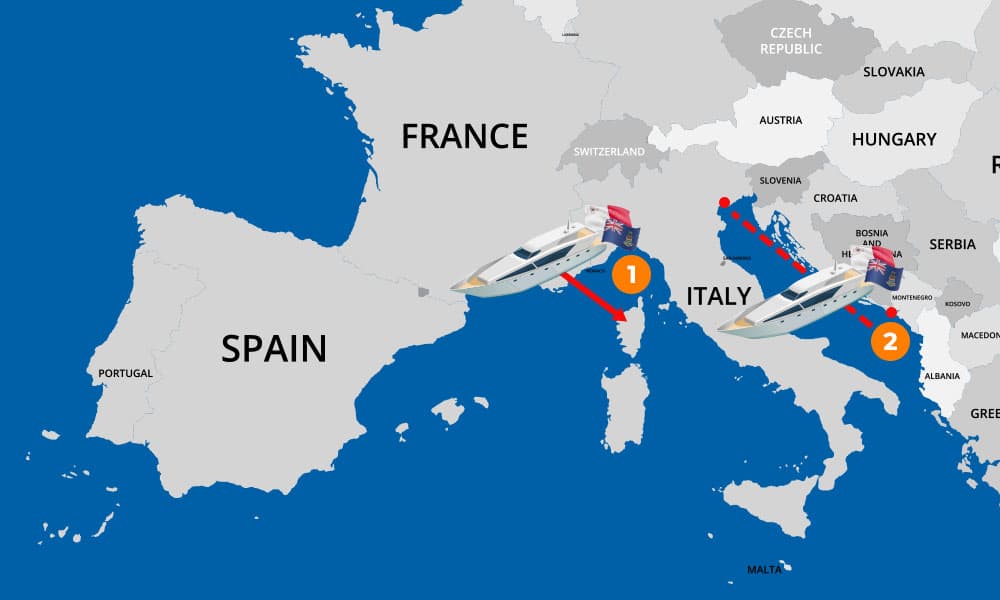

Charters from a European Union country (France) using international waters

You are a shipping company based in Malta. You organise charters from France. One of your clients is planning a stopover in Corsica. This route uses international waters (more than 12 nautical miles).This charter is subject to VAT in France. As France has opted not to tax the part of the charter located outside EU waters, you will be able to reduce your VAT bill if you can provide certain proof.

- Until 31st October 2020, charter fees were taxable in proportion to the use of the vessel in EU territorial waters. As this share became difficult to determine, the ship hiring client could apply a flat-rate reduction of 50% on the total amount of the fee, regardless of the nature of the vessel concerned.

- As of 1st November 2020, hire fees are in principle fully taxable in France. However, the part of the fee corresponding to the proportion of the actual use or operation of the vessel outside the territorial waters of the EU is exempt from VAT under Article 59a of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax. It is the taxpayer’s responsibility to assess the part of the fee that is exempt and this can be subject to inspection by the authorities. The taxpayer may corroborate the assessment by any means.

You need a tax representative to register for VAT and file your VAT returns in France with the required documents.

![]()

Charters from outside the European Union (Montenegro) using Community waters (Italy)

You are a shipowner based in Malta and are organising a charter from Montenegro. One of your clients is planning to sail in Italian waters.

As Italy has opted to tax the part of the charter located in Italy (based on the time spent in Italian waters), you will have to pay Italian VAT on this part of the charter.

You need a tax representative to register for VAT and file VAT returns in Italy with the required documents.

These examples are given to clarify VAT mechanisms and explain your obligations. It is worth checking the regulations for your particular transactions in line with the law, doctrine and practices in each of the EU member States. Contact us for more information!

Why do you need a

fiscal representative?

A tax advisor or fiscal representative can register for VAT on your behalf and help you fulfil your obligations in each of your charter’s departure countries.

European regulatory references

1. The place of short-term hiring of a means of transport shall be the place where the means of transport is actually put at the disposal of the customer.

2. The place of hiring, other than short-term hiring, of a means of transport to a non-taxable person shall be the place where the customer is established, has his permanent address or usually resides.

However, the place of hiring a pleasure boat to a non-taxable person, other than short-term hiring, shall be the place where the pleasure boat is actually put at the disposal of the customer, where this service is actually provided by the supplier from his place of business or a fixed establishment situated in that place.

3. For the purposes of paragraphs 1 and 2, ‘short-term’ shall mean the continuous possession or use of the means of transport throughout a period of not more than thirty days and, in the case of vessels, not more than 90 days.

Source: Article 56 of the Directive 2006/112/EC

In order to prevent double taxation, non-taxation or distortion of competition, Member States may, with regard to services the place of supply of which is governed by Articles 44, 45, 56, 58 and 59:

(a) consider the place of supply of any or all of those services, if situated within their territory, as being situated outside the Community if the effective use and enjoyment of the services takes place outside the Community;

(b) consider the place of supply of any or all of those services, if situated outside the Community, as being situated within their territory if the effective use and enjoyment of the services takes place within their territory.

However, this Article shall not apply to electronically supplied services where those services are supplied to non-taxable persons established outside the Community.

Source: Article 59a of the Directive 2006/112/EC

1. Member States shall take the measures necessary to ensure that the following persons are identified by means of an individual number:

(a) every taxable person, with the exception of those referred to in Article 9(2), who within their respective territory carries out supplies of goods or services in respect of which VAT is deductible, other than supplies of goods or services in respect of which VAT is payable solely by the customer or the person for whom the goods or services are intended, in accordance with Articles 194 to 197 and Article 199;

(b) every taxable person, or non-taxable legal person, who makes intra-Community acquisitions of goods subject to VAT pursuant to Article 2(1)(b) and every taxable person, or non-taxable legal person, who exercises the option under Article 3(3) of making their intra-Community acquisitions subject to VAT;

(c) every taxable person who, within their respective territory, makes intra-Community acquisitions of goods for the purposes of transactions which relate to the activities referred to in the second subparagraph of Article 9(1) and which are carried out outside that territory.

(d) every taxable person who within their respective territory receives services for which he is liable to pay VAT pursuant to Article 196;

(e) any taxable person who is established within their respective territories and who, within the territory of another Member State, supplies services for which only the customer is liable to pay VAT pursuant to Article 196.

2. Member States need not identify certain taxable persons who carry out transactions on an occasional basis, as referred to in Article 12.

Source – Article 214 of the Directive 2006/112/EC

A simple, reliable and efficient solution for all your VAT obligations in all EU countries and some non-EU countries.

Contact

an expert

Easytax International assists you and takes care of all your VAT and customs operations in the complex yachting sector.

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.