What is VAT and what are the specifics within Europe? Are the rules the same in all EU countries? How to fulfil your Intra-Community VAT obligations?

It isn’t easy for foreign operators or the uninitiated to understand the issues around VAT without a wider understanding of the regulatory framework governing Intra-Community VAT. Here are the main points.

The basics of Intra-Community VAT

What is VAT?

Invented in 1954 by the French finance inspector Maurice Lauré, Value Added Tax (VAT) exists today, in various forms, in more than 120 countries around the world.

VAT may relate exclusively to sales to end consumers, or, according to the country, it may apply to the various phases of a commercial cycle, including B2B: the purchase of raw materials, operating costs, production, purchase/resale and then sale to an end consumer. This is the case with the Intra-Community VAT mechanism.

The VAT mechanism applies to all stages of a business cycle in Europe, whether the transactions are between two (or more) companies (called “taxable persons”) or sales to individuals and end consumers (“non-taxable persons”).

Intra-Community VAT regulations: partial harmonisation

- a uniform calculation basis

- for minium VAT rates

- relative homogenisation of domestic legislation.

VAT rates in the European Union

VAT rates, which differ from one Member State to another, are governed by:

- a “standard” rate (which applies to most goods and services),

- “reduced” or “super-reduced” or “zero” rates which can be applied to food, medicines or newspapers, for example, depending on the country.

>See our blog for an update on VAT rates in the European Union.

EU Member States have some flexibility in determining the applicable VAT rates, but cannot have a standard rate below 15%, and a reduced rate below 5% – with some exceptions.

This rate is applied on aprice excluding VAT rate( “excl. VAT” ) which includes the selling price of a good or a service, as well as the costs necessary for this sale (transport costs, for example, for the sale of an item).

The common rule for Intra-Community VAT

The common rule for a company established within the European Union (taxable person and liable for VAT) on domestic transactions (internal market), is as follows:

- Purchasing: the company handles the VAT on its purchases from other companies. This VAT is paid to the suppliers, but is deductible for the purchasing company.

- Sales: the company must tax its sales to companies and individuals. This VAT is invoiced to customers, collected by the selling company, and must be paid to the tax authorities. Only the end consumer/private individual (non-taxable person) pays the VAT and is not entitled to deduct it.

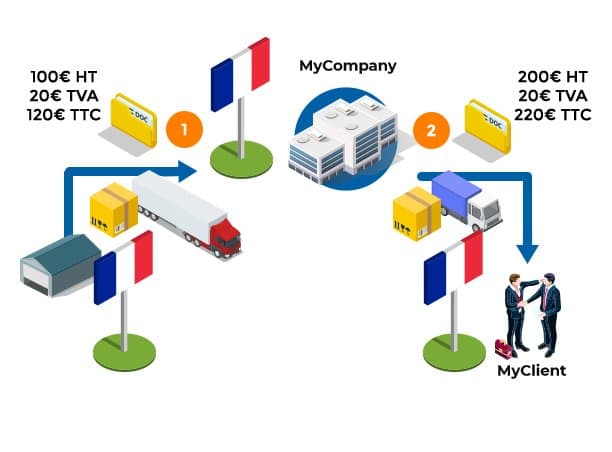

Example of a domestic purchase/resale in France:

Let’s take the example of a French company that buys goods from a supplier (B2B) and resells these goods to an individual (B2C):

B2B domestic purchase

For a purchase of 100€ excl. VAT, “Mycompany” :

- pays €20 VAT to his supplier.

B2C domestic sales

For a sale of €200 excl. VAT, the seller:- collects €40 of VAT from its customer.

- Collected VAT 40€ – deductible VAT 20€ = 20€ of VAT to pay to the tax authorities.

- is charged €40 VAT as a final consumer.

VAT exemptions and refunds

Some sales transactions may be exempt from VAT, such as:

- Exports – shipment of goods from an EU Member State to a country outside the EU

- Intra-Community deliveries – sales and shipment of goods from one EU Member State to another, if the customer is a company.

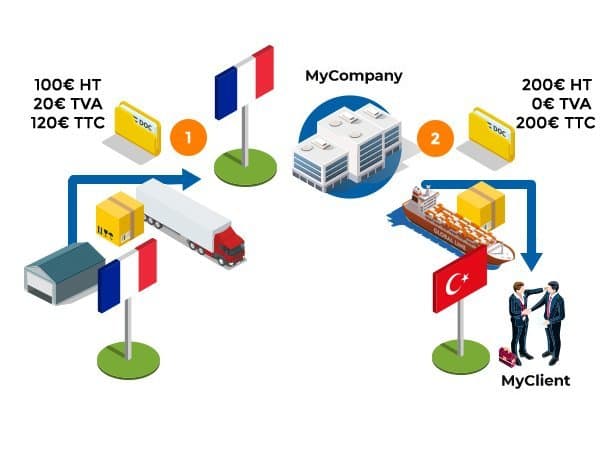

Example of an export:

A French company buys goods from a supplier in its own country and sells them to an end customer outside the EU, in China.

B2B domestic purchase

For a purchase of 100€ excl. VAT, “Mycompany” :

- pays €20 VAT.

Exporting:

For a sale of 200€ HT, “Mycompany” :

- collects 0€ of VAT on its sale.

Collected VAT 0 € – deductible VAT 20 € =20 € of VAT for which a VAT refund request is sent to the tax authorities.

Other provisions

In addition to these basic principles, the Intra-Community VAT rules contain a number of provisions and special cases which mean that every transaction may require detailed examination:

- Provisions relating to types of transaction : VAT-free imports, VAT exemptions, reverse charge mechanism (see below)

- Specific provisions for certain sectors: storage platforms, construction, e-commerce, etc. > see our > sector guides

- Provisions defined by each country see our country guides.

Intra-Community VAT for foreign operators

General rules and specific schemes

A foreign company that is not established in an EU Member State but carries out taxable operations there, is, like European companies, subject to the VAT mechanisms described above.

Specific scheme: reverse charge mechanism

The reverse charge mechanism autoliquidation (in French) allows foreign companies in some EU Member Statesto avoid registering for VAT and declaring and paying VAT in these countries: : it is then their end customer in that country who will be responsible for paying the VAT to the relevant tax authority.

Why is it important to ensure your VAT compliance in Europe?

It is essential for foreign companies operating within the European Union to ensure they make the correct VAT payments at the right time, otherwise they will incur financial penalties which can affect their profitability, and may also penalise their European business partners. Good management of your VAT system also means you’ll benefit from any refunds, exemptions or reverse charge opportunities

What are your VAT obligations as a foreign trader in the EU?

As a foreign company carrying out taxable operations within the European Union, you are likely to be subject to the following obligations in each/some of the countries where you operate :

- registering for a VAT number

- filing of VAT returns and paying VAT to the tax authorities

- Intrastat and EC Sales List returnsif applicable .

Appointing a fiscal representative is the safest and least expensive way to meet these to meet these obligations.

Why use a

fiscal representative?

Companies established outside the EU that carry out taxable operations in EU Member States are obliged to appoint a fiscal representative to ensure their tax compliance with the local authorities. A fiscal representative will handle all the necessary steps to obtain the required VAT numbers, and perform all other declarative obligations.

Companies established within the European Union are allowed to undertake these steps themselves, but most also prefer to appoint a “tax advisor” to minimise the hassle of VAT compliance. These experts are undoubtedly the best placed to handle thevast differences between the Member States:

- the languages used

- the doctrines (local practice)

- the procedures for obtaining an Intra-Community VAT number

- the format and arrangements for VAT returns (period, submission dates) – VAT rates, etc.

A simple, reliable and efficient solution for all your VAT obligations in all EU Member States and some non EU countries

Tell us about your operations and we will help you manage your obligations

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.