Since Brexit, selling to private consumers (B2C) in the European Union (EU) has become significantly more complex for UK distance sellers. The days of effortless trade within the Single Market are long gone, replaced by a labyrinth of VAT regulations, Customs declarations, and compliance requirements. Even tough, most companies consider sales to EU consumers as regular exports carried out from the UK, it is not always the case and can trigger VAT obligations in the EU for UK businesses.

Today, UK companies must answer so many questions prior to tapping into a new EU market : do I need to register my company for VAT purposes in the EU? If so, in which country(ies) ? How do I handle sales? Do I need to charge VAT? Which VAT rate is applicable? How do I report my sales? How do I handle Customs clearance? The list is endless. It has become essential to understand the impact European VAT laws can have on sales otherwise; a poor management could be costly to businesses that did not anticipate such intricacies.

Adding to this level of complexity are new regulations, such as the implementation of both Import One-Stop Shop (IOSS) and EU One-Stop Shop (OSS) plus the upcoming ViDA reform, which aim to simplify processes but often leave businesses struggling to keep up with the pace of change and sometimes requires setting up a fiscal representation.

In this article, we will explore a couple of options available to UK companies willing to sell to EU consumers while ensuring full VAT compliance. Whether you are a small business shipping across borders, a larger organisation managing multi-country sales or even a company selling cross-border on marketplaces like Amazon, this article will shed some lights on the potential pitfalls and how to navigate them effectively.

1st solution : Shipping from the UK directly to EU end consumers (B2C)

Can I always consider sales to EU consumers as exports from the UK?

While shipping directly to European consumers could be considered as the easiest way to proceed, it does not alter the fact that VAT questions need to be answered. To illustrate this, let me give you an example: a UK company was registered for VAT purposes in Germany before Brexit because of the annual distance selling threshold being breached. At that time, the company was importing goods into Germany while acting as importer of record and was including German VAT on its local sales.

After Brexit, the company decided to cancel its VAT registration as goods where shipped directly from the UK to local consumers resulting in an invoicing from the UK without VAT as regular exports. VAT was supposed to be settled by the end customer upon delivery of the goods. The German Tax Office sent an enquiry to the UK company asking about the status of sales post-Brexit.

Even though the company provided evidence to show that VAT was no longer handled by the company itself but rather by the end customers, the German Tax Office refused this allegation because it was not clearly stated in the company’s Terms and Conditions.

It also mentioned that the importer of record could not be the end customer because the company did not have any authorisation to do so. As a result, the company had to pay VAT on sales even though it dot not collect any VAT resulting in a 19% loss on its margins.

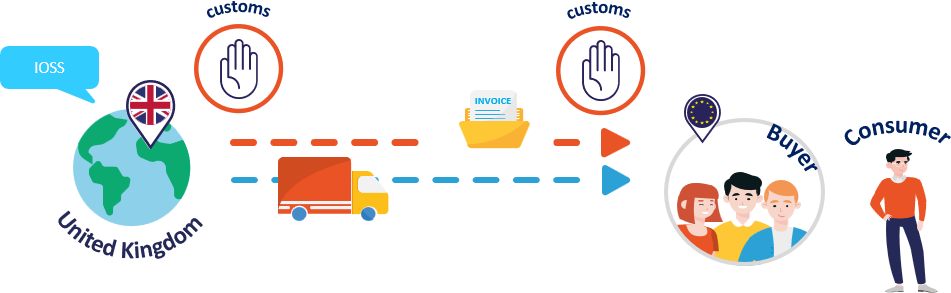

The IOSS framework: a solution with limits

To avoid such unfortunate situation, companies can benefit from an EU-wide simplification when shipping consignments of a value lower than EUR 150 directly from a non-EU country to EU consumers; this is called the Import-One Stop-Shop (IOSS). Once registered on the IOSS portal through an intermediary, companies can collect output VAT on EU sales (VAT rate applicable in the country of destination). Each month, companies will submit IOSS returns and pay the amount of output VAT collected to the country of registration. This Member State will then transfer VAT due in each Member State depending on figures reported on the return.

In terms of import VAT, the IOSS comes with a Customs simplification: when companies show that they are registered on the IOSS and VAT was collected on sales, there is no import VAT to pay.

While this system offers a real advantage for companies to ensure EU VAT compliance through a single point of registration, it is not an ideal solution. There are two main limits:

- The system is currently limited to consignments with a value lower than EUR 150 due to Customs implications. When importing low-value goods into the EU, there is no Customs duties applicable. There are some serious discussions about increasing the value of consignments to simplify even further the system for distance sellers ;

- The system is not mandatory for distance sellers yet. It results in a high amount of VAT fraud from companies based outside of the EU treating transactions as export from their home country without collecting any VAT. Unfortunately, because of high and still increasing volumes of consignments, it is realistically impossible to check all parcels at Customs to stop goods on which VAT was not collected. Once again, the system should become mandatory in future developments.

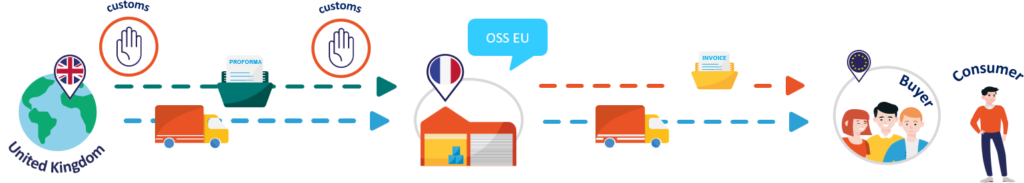

2nd solution : Shipping from an EU warehouse to EU end consumers (B2C)

Another approach would be setting up a storage facility in the EU, let’s say in France, before shipping goods to EU end customers. This solution allows UK companies to minimise VAT requirements while ensuring VAT compliance across the EU. To fully understand this solution and its requirements, let’s focus on each phase separately.

Importing goods into France

Goods can be imported from the UK or from any non-EU location into France. This actually opens the possibility of asking your suppliers to ship directly to your warehouse instead of going through the UK first. If goods are subject to Customs duties, it could be an interesting scenario to avoid a double payment of duties both in the UK and in the EU.

To act as importer of record in France, your company must be VAT registered in France and have an EU EORI number. The advantage of going through France is that, as soon as a company has a French VAT number, there is no payment of import VAT any longer. France implemented the equivalent of a mandatory UK Postponed VAT Accounting (PVA) back in 2022. Instead of paying import VAT and getting it back from the French Tax Office, it has become a reporting obligation without payment as such.

Tips

When non-EU companies want to act as importer of record in the EU, they have to pick their Customs agent wisely. When dealing with non-EU companies, Customs brokers become jointly and severally responsible on behalf of their clients. This is called an “Indirect Customs Representation” and many brokers do not offer this level of service making it impossible to Customs clear on behalf of non-EU clients. As a result, you have to make sure the broker you chose offers an Indirect Representation otherwise clearance won’t be done and goods will be stuck at Customs while waiting for another broker to accept the clearance.

Selling goods across the EU from your EU warehouse

Although your company is now registered for VAT purposes in France, this level of compliance will only open the door to the French market, which is not sufficient. To sell across the EU and ensure VAT compliance, your company will need to activate the One-Stop-Shop (OSS) EU scheme. The OSS must be implemented in the country where your storage facility is located. Once activated, your company will be able to collect EU VAT on sales (VAT rate applicable in the country of destination). Each quarter, companies will submit an OSS return and pay the amount of output VAT collected to the country of registration, France, in our example. France will then transfer VAT due to each Member State according to figures provided in the OSS return.

Using a storage facility in France allows UK companies to register for VAT purposes in France and ship goods to France in bulk reducing compliance and logistics costs. By simply adding an OSS EU scheme, companies can also sell at an EU scale without triggering extra VAT obligations in other Member State.

As a conclusion, navigating the complexities of EU VAT compliance post-Brexit can feel overwhelming; but solutions like the IOSS, VAT registrations and OSS EU scheme offer valuable opportunities for UK businesses to tap into the European market. Whether opting for the IOSS to simplify VAT on low-value consignments or leveraging an EU storage facility to benefit from the OSS EU scheme or even using both options, these frameworks can significantly lower the compliance burden. However, implementing these solutions is not without its challenges. From guidance on solutions adapted to different businesses to aligning with country-specific VAT rules, the details can quickly become complex. This is where VAT representatives can make a difference and offer tailored advice; ensure compliance while businesses focus on their growth and walking you through every step of the way while keeping an eye on future changes.

Moreover, combining these solutions can provide even greater flexibility to address the unique logistics challenges faced by e-commerce businesses. By working with experienced professionals, UK companies can turn VAT compliance into a strategic advantage, allowing them to focus on growth while meeting their obligations with confidence.